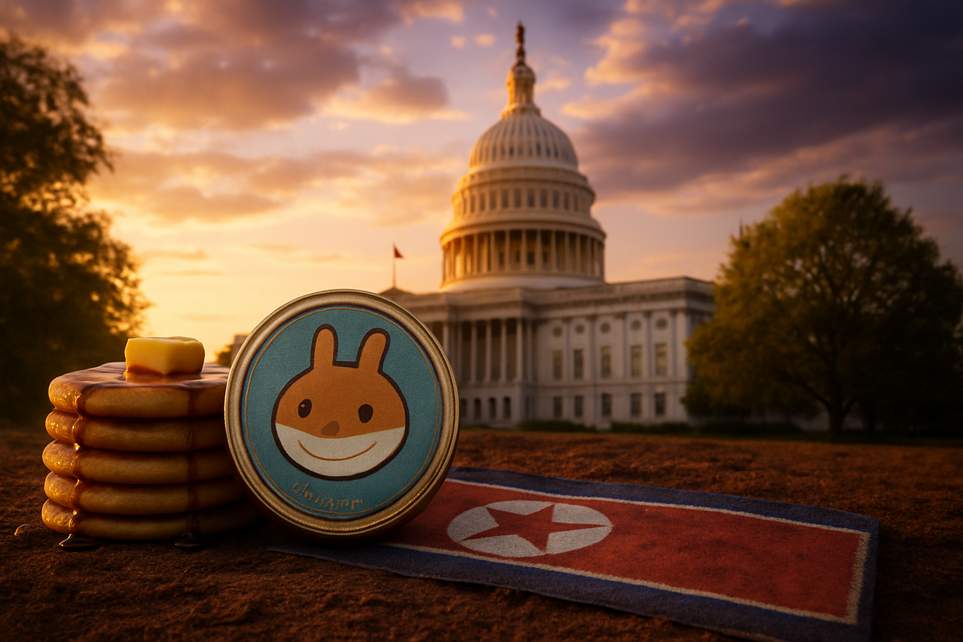

Warren Pins PancakeSwap to Pressure Regulators on Trump-Linked Crypto

Why Warren picked PancakeSwap (and yes, it’s deliciously strategic)

In mid-December, a senator put two agency chiefs on notice and dropped a tasty-sounding name into the conversation: PancakeSwap. The ask was simple on paper — are Treasury and the Department of Justice looking into national-security risks tied to decentralized exchanges? — and brutally clever in practice. By calling out PancakeSwap, the letter turned a sprawling, techy policy fight into something you can point at and talk about at dinner.

The letter named the Treasury head and the Attorney General and leaned on reports that a particular decentralized exchange had been used in money flows tied to cybertheft and sanctions concerns. It also tied that exchange to trading activity around a token linked to a private crypto venture, raising the specter of conflicts if regulators are supposed to police markets that might benefit political figures.

That framing is political genius because it puts regulators in a very awkward bind. If they say, “Yes, we’re investigating,” they risk revealing sensitive enforcement strategies. If they say, “No,” they hand the senator a soundbite that looks like regulatory negligence. Either way, she gets to claim momentum and shape the public record — and that record can be handy when Congress is dithering over new laws.

What this means for regulators, DeFi, and writing the next law

At the technical level, decentralized exchanges are messy. There isn’t a single office you can subpoena and a single account you can freeze. DEXs are stitched together from smart contracts, liquidity pools, front ends, wallets, and developer groups. You can disrupt some pieces — a hosted website, an app store listing, a developer organization — but you can’t flip one switch and stop swap traffic the way you can stop a bank wire.

That’s where the senator’s questions do real work. Rather than theatrics alone, she asked agencies to catalog national-security risks, flag legal gaps, and explain how they’d prevent political interference or conflicts tied to a private venture. In other words: if today’s toolset falls short, tell Congress what tool to hand you next.

There are counterarguments worth hearing. On-chain activity is more transparent than many realize: blockchain records let sleuths follow flows if they know what they’re looking for. A lot of DEX trading is boring normal stuff — market makers, speculators, arbitrage. And the industry itself has been testing compliance layers like wallet screening and front-end controls. So it’s not a lawless thrift shop out there — it’s a different kind of plumbing.

Still, the tradeoff is real: DeFi makes it easier to move value without formal accounts, but it also makes flows auditable in ways traditional finance is not. Politicians and regulators can lean on either half of that sentence depending on the headline they want.

The broader political angle matters, too. Congress has been poking at market-structure bills for months. The House pushed a federal framework earlier in the year, but the Senate hasn’t settled on a path. When legislation stalls, oversight letters like this become a form of leverage — they create a public paper trail, force answers, and shape the optics that help or hurt future votes.

Where this goes next depends on choices. One path is targeted rules that focus on identifiable interfaces, promoters, and intermediaries while accepting the technical reality that code itself isn’t a person. The other is sweeping language that treats decentralization as suspect, which would likely drive activity offshore and encourage shadowy workarounds. Both are political outcomes as much as policy ones.

Ultimately, the move is a reminder that in modern rulemaking, politics is often the scaffolding for law. The senator didn’t just raise a compliance question — she turned an obscure software stack into a headline-friendly symbol, and forced regulators to pick how they’ll answer in public. Hunger for pancakes not required, but spectacle helps.